Our Humbled Trader review aims to show you who she is and how you can learn about her trading techniques.

Disclaimer: There are affiliate links on this page. This means that if you click through and purchase anything, I might earn a commission for the introduction with no extra cost to you. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of stockalertsreviewed.com. We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

If you browse YouTube for stock trading channels, you have probably come across Humbled Trader.

Her videos are honest, funny and very direct. Her content is all useful content with no fluff. Most of it is free as well!

Check out my #1 Recommended Stock Alerts Service right now…

Limited Time Deal to Purchase Nate Bear’s Profit Surge Trader ASAP HERE

You can also watch a full interview with Nathan Bear discussing the Profit Surge Trader system here.

***********************************************************************************************************************************

Investing Wizard Who Turned $37K Into $2.7M in Just 4 Years Makes His Next Big Move

|

He started from nothing and became a multimillionaire…

He’s now one of the most sought-after trading experts…

Yet he operates 858 miles from Wall Street.

And now, he’s revealing his #1 favorite strategy that targets MASSIVE weekly profits with just one stock ticker.

************************************************************************************************************************

FB Group and Free eBooks

I invite you to join my Facebook Group for a community of traders that is interested in learning about and testing the best stock alert services

If you are interested in learning an options trading strategy with a 95% win rate……check out my store of free eBooks!

Who Is Humbled Trader?

Her name she uses is ‘Shay’ and she is a day trader from Canada.

I really like her open, honest and hilarious approach to day trading education.

She has many other revenue sources. She most likely makes money from YouTube ads, her own stock trading education services among others.

Humbled Trader net worth is estimated to be somewhere between $500k and a few million dollars. This however, is pure speculation and cannot be confirmed. However, it is reasonable to assume this from her YouTube ad revenue etc.

She also really doesn’t like the conventional way that stock traders sell their courses and services. The ‘Tim Sykes’ lifestyle marketing approach is NOT her thing and she pokes fun at it a lot!

LEARN HOW TO WIN 90% OF YOU TRADES IN 90 SECONDS!

Humbled Trader Trading Strategy

You can learn more about the Humbled Trader trading strategy on her website or YouTube channel. She is very much a day trader that prefers to use price action and volume instead of patterns.

One of her tendancies is to trade stocks ‘long’ betting that they will increase in price. Additionally, she will buy anything from penny stocks to large cap!

I haven’t really seen her trading options, crypto or Forex.

Humbled Trader Discord Review

While Shay provides a TON of free content on her YouTube channel, she also has a premium service on Discord.

For a long time she didn’t appear to have any paid product or service.

Now she does and it’s AWESOME! Check it out here.

However, it looks like she is expanding her business (Humbled Trader Inc.) and early 2020 she entered into an agreement with Huma Holding (a private equity firm) with the idea of growing her business to a valuation of $2MM+.

Shay’s discord chatroom is priced mid-range – $139 a month.

Bullseye Trades: Best Alerts Service

If you are on a budget, I highly recommend checking out my RagingBull Bullseye Trades review. It’s a very high value alerts service for a very low cost with a fantastic track record!

Every Monday at the market open, Jeff (seen below) sends you his weekly Bullseye Trade.

2024 has had a SOLID start for these Bullseye Trades!

(+50% to 300% per week in my experience)

>>> Click here to learn more! <<<

************************************************************************************************************************

******UPDATE: As of 2021 you can only purchase Shay’s discord alerts if you pay for her new Humbled Trader Academy. You get a year of the discord alerts with the course.******

She offers a bunch of interesting features that are aimed at teaching traders rather than spoon feeding them stock alerts. Here is a brief summary of what you get in the premium Humbled Trade Discord chatroom.

– Pre-market analysis of the hottest stocks etc. News, PR’s and any major catalysts seem to be discussed at these briefings.

– During market hours she gives a running text commentary in the chatroom on stocks, news and the market conditions.

– A lot of video lessons that are relevant to today’s market and are constantly updated.

Here is what her website states you get…..

My Experience With Humbled Trader Discord

I signed up to check out her Discord. It seems well organized with the main attraction being her pre-market livestream on Zoom where she talks us through her watchlist building, This starts around 8:30am ET and last about 30 mins.

If you want to see the end result of her watch list building, I have included a lot of examples after this section. Typically, there are 3-5 stocks that she analyzes and watches. Sometimes, she buys then and sometimes she goes with something else entirely.

Limited Time Deal to Purchase Nate Bear’s Profit Surge Trader ASAP HERE

You can also watch a full interview with Nathan Bear discussing the Profit Surge Trader system here.

***********************************************************************************************************************************

Investing Wizard Who Turned $37K Into $2.7M in Just 4 Years Makes His Next Big Move

|

He started from nothing and became a multimillionaire…

He’s now one of the most sought-after trading experts…

Yet he operates 858 miles from Wall Street.

And now, he’s revealing his #1 favorite strategy that targets MASSIVE weekly profits with just one stock ticker.

************************************************************************************************************************

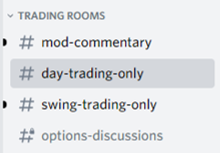

Humbled Trader Discord Channels

Here are the main ‘alert’ channels. Simple layout is nice…..

Mod-commentary is only for the mods to put in some simple one line ideas here and there. No trade alerts in here, just narrative like ‘$NIO red’ etc.

Day-trading-only is my favorite room as it is where Humbled Trader interacts and posts her buy/sells on the day trades.

She is fairly active. The only downside here is that her alerts are posted amongst all the subscribers chatter so it is hard to just follow her ideas – a stand-alone HT only channel would make it easier to filter out the noise.

The swing trading channel doesn’t seem to have any contribution from HT. It is mainly the mods and subscribers taking swing trades.

Here is a video I did documenting the inside of the Humbled Trader Discord room (includes a quick peek at my first trade with her in one of my broker accounts)

Bullseye Trades: Best Alerts Service

If you are on a budget, I highly recommend checking out my RagingBull Bullseye Trades review. It’s a very high value alerts service for a very low cost with a fantastic track record!

Every Monday at the market open, Jeff (seen below) sends you his weekly Bullseye Trade.

2024 has had a SOLID start for these Bullseye Trades!

(+50% to 300% per week in my experience)

>>> Click here to learn more! <<<

************************************************************************************************************************

Humbled Trader Watchlist

She also has a lower cost service where she sends you the Humbled Trader Watchlist every morning at 9am. Included is her favorite 3-5 stocks for the day and a trading plan. Plus, also includes a video as well.

I joined this service – it seems like great value for only $47 a month.

You can learn more about Humbled Trader’s chat room and watchlist service on her website.

You get her email watch list at 9am – 9:15am every morning. She uses a lot of abbreviations – so many she has had to make a full list that she sends out. See below, especially the one near the bottom in red (her humor coming through!).

‘WL Key Terms- How to Use Humbled Trader Watchlist?

Key Level/Pivot- Psychological price level that signals whether the stock is bullish or bearish short term for day trading. Also known as the “over under” level. Key level is also a potential level to set your risk/stop

LEARN HOW TO WIN 90% OF YOU TRADES IN 90 SECONDS!

>> CLICK HERE TO LEARN MORE! <<

Float- Amount of shares outstanding available for trading by the public

WL – Watchlist

IO- Institutional Ownership %

MC- Market Cap

Short %- If the number is over 20%, I consider the stock highly shorted

Potential dilution- Low on cash, S3, F3, S1 filed, ATM offering potential, Warrants/ convertibles outstanding

SSR – short sale restriction. means short sellers can only short on the ask, on uptick. and cannot short weakness on the bid. SSR doesnt mean it will short squeeze, but many times it does

ETB – Easy to borrow. Meaning the stock has a lot of shorts, and likely to squeeze.

HTB– Hard to borrow. Meaning the stock is hard to find short, and not as likely to squeeze.

PM – Pre market

AH – After Market

PH – Power Hour

SS- Short Sell

Bot- Buy, or Long

SL- Stop loss, or “stops”

RR – Risk to Reward

Res- Resistance Line

Supp- Support Line

R/G- Red to green

G/R- Green to red

PMH- Premarket highs

PML- Premarket Lows

LOD- Low of the day

HOD- Hight of the day

Front side- Strength is very strong and holding breakout with volume, generally from open to 11am EST.

Back side- Stock strength is overall dying, volume drying, generally after 11am EST

PDC- Previous day close price

ATH- All time high. Stocks that break ATH tends to go HIGHER

ATL- All time low. Stocks that break ATL tends to go LOWER

ON – Overnight

Pop- When a stock candle shoots up to above average range really quick. Usually at the open.

Grind- When a stock candle gradually climb up. Usually in mid day/afternoon.

Rug Pull- Same as a “dump”. When a stock (usually small caps) suddenly gets a quick and drastic sell off. Opposite direction of a “Pop”.

POS – Piece of sh*t, or Turd. Often used term on small cap pigs.

WW- Worth watching, meaning a stock seems to be setting up for a play soon, pending volume and trend confirming’

So, you can see that you need to get familiar with her terminology before you can quickly assess her watch list. She makes it clear that these watch lists do not constitute any kind of ‘buy alert’.

Sidenote: Come and join our Facebook group (6000+ members!) where we discuss stock alerts services.

Humbled Trader Review: Example Watchlist

I signed up for the $47 a month watchlist that is sent out pre-market.

Limited Time Deal to Purchase Nate Bear’s Profit Surge Trader ASAP HERE

You can also watch a full interview with Nathan Bear discussing the Profit Surge Trader system here.

***********************************************************************************************************************************

Investing Wizard Who Turned $37K Into $2.7M in Just 4 Years Makes His Next Big Move

|

He started from nothing and became a multimillionaire…

He’s now one of the most sought-after trading experts…

Yet he operates 858 miles from Wall Street.

And now, he’s revealing his #1 favorite strategy that targets MASSIVE weekly profits with just one stock ticker.

************************************************************************************************************************

Here is the day 1 watchlist. After each entry in the list, I will give a quick commentary on how the trade worked out.

Humbled Trader Watchlist Review: Day 1 (7/29/30)

Here is the list that was sent out around 9am ET.

‘HTBX $2.93 (Heat Biologics shares are trading higher after the company announced its coronavirus vaccine demonstrated immunogenicity proof-of-concept in pre-clinical studies.)

-79M float, $73M MC, S3

-Recent bag holder chart that ran up to $4.3 in early July

-Since that run, this has had consecutive red days for over a week so I am leaning bearish on the name

-Key level to watch in today is the $2.9’s area

-Leaning bearish on this ticker

-Ideally I would want to see this run towards $3.5-$3.7s to take a starter short, but will set the risk tight

-IF it shows strengths, I will cut it, no hesitation

-Above key level, we can see $3.05, $3.25, $3.5, $4’s

-Below the key level, we can see $2.7, $2.5, and back below $2’s

How it worked out: $HTBX failed to break over the key level of $2.9. It presented an opportunity to short from the $2.8’s all the way down to below $2.5 within an hour or so. I think this was a pretty good call from Humbled Trader! A short position near market open could have resulted in a relatively quick 20% profit.

Here is the chart for the first couple of hours. A nice short as she indicated in the watchlist.

-22.7M float, $340M MC

-Once President Trump had his press conference and mentioned KODK, it has been on a massive squeeze AH yesterday. Recovered all the way from $7.50

-Long bias but will turn into a massive short if it continues on this path of super over extension. Again do not chase into parabolic moves with no clear support nearby.

-Plan your trade along key levels with clear exit plan in mind before entering the trade

-PM support level is around $13.5 area. Above it KODK continues to remain strong

-Below $13.5, $12.75 and $12 are decent support areas

-Ideally trade this on pullbacks to key support areas risking break of that support area

-Do not continue to hold your position if trade is not working or if there is a trend reversal

-Bullish news, gapping up thin into daily

-Expect some profit taking early on, and then reclaim of key level for a next move up higher

-$22.3’s-22.5 the key area to hold on the stock, if we sell off early at the open, we have some downside

-Below key area we have support around low $21’s, and we could possibly get $20.5’s

-Look for potential curl at those bottom support levels for a trend reversal to retest highs

-If we reclaim key area of 22.3’s-22.5’s, we can test PMH $23’s, and then $23.5 $24 daily levels

Bullseye Trades: Best Alerts Service

If you are on a budget, I highly recommend checking out my RagingBull Bullseye Trades review. It’s a very high value alerts service for a very low cost with a fantastic track record!

Every Monday at the market open, Jeff (seen below) sends you his weekly Bullseye Trade.

2024 has had a SOLID start for these Bullseye Trades!

(+50% to 300% per week in my experience)

>>> Click here to learn more! <<<

************************************************************************************************************************

-Nice beat as well as guidance raise. However we did run up into earnings for multiple days.

-Not looking to fight trend on an earnings winner. Watch how the stock reacts to key level after open to determine direction long or short.

-$74.8’s the key area to hold in order to stay bullish on the stock

-That level holds, we can retest PMH $75.8, then new daily highs $76.4’s

-If we really push and go parabolic we can see $79’s possible

-However, if we are unable to hold key level $74.8’s, we have downside to sell off the gap

-Downside support we can see $73.5s, and then $73s, $71.8’s

-If we do sell off heavy at the open, let it settle and hold a LOD and start trending up to join for a potential reversal. Do not pick bottoms’

Limited Time Deal to Purchase Nate Bear’s Profit Surge Trader ASAP HERE

You can also watch a full interview with Nathan Bear discussing the Profit Surge Trader system here.

***********************************************************************************************************************************

Investing Wizard Who Turned $37K Into $2.7M in Just 4 Years Makes His Next Big Move

|

He started from nothing and became a multimillionaire…

He’s now one of the most sought-after trading experts…

Yet he operates 858 miles from Wall Street.

And now, he’s revealing his #1 favorite strategy that targets MASSIVE weekly profits with just one stock ticker.

************************************************************************************************************************

Humbled Trader Review: Day 2 (7/30/20)

Here is the pre-market watchlist that was sent out. I will provide a brief commentary after each entry regarding how the trade went and if/how I played it.

-21M float, $149M MC, S3

-Another EV name that made a decent run in after hours trading yesterday

-Key level to watch in today will be $12.65

-If we can hold above this level and strong buying volume comes in, this can take off

-Below the key level, this may turn to a 50/50 trade

-Above key level, we can see ATH at $15 and once we clear ATH, all bets are off then

-Over ATH we can expect $16.25, $17, $18.6

-Below the key level, we can see $11.1, $10, $9.25, and below

-2.7M float, $100M MC

-Gapping up over 125% this PM. Ran last year to $13.5 on big volume so that is a resistance to be aware of.

-No bias on it yet

-PM support level is around $12.15 area. Above it EDSA continues to remain strong

-If it gets over $13.5 and reclaims that area, then I would be very bullish

-Below $12.15 the final line in the sand is $9.75 area

-Ideally trade this on pullbacks to key support areas risking break of that support area

-If $9.75 fails it is heading to $8.5 and $8

-Plan your trade along key levels with clear exit plan in mind before entering the trade

-Bullish gap up into key daily gap fill area, if we can hold above it today this could turn into a nice daily breakout.

-Wait to see how the stock trade around the key area o f$13.8’s

-If we can hold that area after open 10-20 min, then we have upside for a steady all day move up higher to see $15, $16.4 PMH

-Above PMH we could see $17, $18

-However, if we cannot hold and consolidate to the upside above $13.8, we have downside to gap fill

-Downside support to sell off tour $13 first, then $12.1, $11

-37M float, $210M MC, S3

-EV name that made a decent run in after hours trading yesterday

-Key level to watch in today will be after hours highs area of $14.9

-Just like many other moves in the summertime, a lot of action in pre-market that tends to fade back before market opens

-Ideally I would want to see this regain and hold key level

-Above key level, we can see $16’s, $18’s, and possible retest of PMH at $19.38

-Below the key level, we can see $13.5, $12.75, $11.9, and possible back to $9’s

-It’s been a while since they beat earnings, especially this time its significant because everyone expected them to lose due to COVID

-Bullish daily chart, if we can hold key area of $68.1’s, we could get more upside on the daily

-Upside if we hold, we can see Test of PMH first around $71, $71.4,s.

-Above that we can see $74, $77.5’s potentially if we really push with high volume

-However, if no buying volume come in and we fail $68.1 key area early on, we have some downside to fill the gap

-Downside we can see $66 first, and then potentially $65′

-2.5M float, $20M MC

-Broke out of ATH (all-time highs) in premarket session and made a really nice push up to $10.4’s

-Has since faded back down to the key level area of previous highs

-Key level to watch in this premarket session is this $7’s area

-No bias on this yet, but would like to see it hold over the ATH for another potential push up

-Above key level, we have $7.4, $8.85, $10.4 PMH

-IF we can break over PMH, the next levels up we will have $10.89, $11.2, $11.65, $11.9

-Unable to reclaim and hold key level we have $6.15, $5.5, $5, $4.5 and below

Bullseye Trades: Best Alerts Service

If you are on a budget, I highly recommend checking out my RagingBull Bullseye Trades review. It’s a very high value alerts service for a very low cost with a fantastic track record!

Every Monday at the market open, Jeff (seen below) sends you his weekly Bullseye Trade.

2024 has had a SOLID start for these Bullseye Trades!

(+50% to 300% per week in my experience)

>>> Click here to learn more! <<<

************************************************************************************************************************

The Humbled Trader Review: Conclusions

I have followed Humbled Trader for a while now and I have always found her YouTube videos to be hilarious and educational.

She did not have anything to sell for most of the time and it has really just been this year that she has started her premium Discord chatroom. However, it’s fascinating to note her partnership with a private equity firm earlier this year, adding depth to my research for this article.

Discovering Humbled Trader’s real identity has been intriguing; a simple Google search unveiled a lot more about her.

Her transition from anonymity to visibility adds an interesting layer to her story.

However, I was asked to remove this information from the article as I was contacted and warned about ‘privacy’ concerns.

Her Discord chatroom seems quite expensive for what it is. However, she is clearly a legit trader with a flair for educating new traders and she appears to have a solid strategy.

So far, I am quite impressed with her daily pre-market watchlist! I am adding it to my secret toolbox that helps me make money in the market every month.

Here is a link to her website where you can explore the different resources that she has and premium programs.

Good Luck!

Russell

Limited Time Deal to Purchase Nate Bear’s Profit Surge Trader ASAP HERE

You can also watch a full interview with Nathan Bear discussing the Profit Surge Trader system here.

***********************************************************************************************************************************

Investing Wizard Who Turned $37K Into $2.7M in Just 4 Years Makes His Next Big Move

|

He started from nothing and became a multimillionaire…

He’s now one of the most sought-after trading experts…

Yet he operates 858 miles from Wall Street.

And now, he’s revealing his #1 favorite strategy that targets MASSIVE weekly profits with just one stock ticker.

************************************************************************************************************************

Humbled Trader Review: Related Articles

Nate Bear Daily Profits Live Review

Tim Sykes Weekend Windfall Training

Tom Gentile Money Map Press Review

wish i had the$$ to play like u appreciate all ur reviews and because of limited funds can only play one or two. which one should i play.

She showed on one of her videos she made $46,000 in one month with her broker’s account statement as proof. She even said that that was one of her underperforming months.

She also came out and said she makes around 34% profit a month on average.

Unless she has some hazardously underperforming months, she would be earning $500k in a year; and that’s excluding any ad revenues on YouTube.

Her net worth in this article is grossly underestimated. Her net worth is definitely more that that.

Shay uploaded a video on March 31st, 2021 showing her trading broker statement.

There she shows she made $46,000 in the month of January alone.

She also reminds the viewer that that was one of her underperforming months.

Unless she has some massive drawbacks along the way, and taking into account that’s how much she earns in her underperforming months,

it would be likely that she earns more than $500k in a year. And that’s disregarding all the ad revenues she makes off of YouTube.

Her net worth in this article are grossly underestimated.

Proof:

https://youtu.be/OZIYR5m5zjc?t=727

Good point – not sure why I put that as her net worth. Her chat room and YouTube alone even if we ignore trading would have her significantly higher.